Building the Right Market Relationships

The elephant drinks at the same watering hole as the other species, but isn't a competitor.

© iStockphoto/cinoby

Is your business an elephant or a tiger?

The tiger, with no natural predators, keeps the populations of deer, wild pig, sambar, and gaur in check. But it hunts alone. To a tiger, everything else is either prey or something to be avoided.

The elephant also has no natural predators but it is a benign and sociable creature, which lives happily with its own kind and acts as a "keystone species," contributing to the survival of other species, too.

The elephant drinks from the same watering hole as all the other animals in the jungle but, rather than being a competitor to them, it is a "co-opetitor." And when the tiger and the elephant meet, it's the tiger that gives way to the mighty elephant.

This article looks at the Value Net Model, a tool that helps your business move away from a "kill or be killed" ethic and achieve greater success by operating alongside, or even in association with, other organizations.

A Spirit of Co-opetition

Co-opetition is a term used to describe co-operative competition. Here, businesses form mutually beneficial partnerships that make both parties more competitive.

Business is full of examples of these "elephant" companies, especially in the automotive industry. In 1991, for example, Ford® and Volkswagen® worked together to produce a single car body that was used in the Volkswagen Sharan, Ford Galaxy and Seat®/VW Alhambra.

Although all three models of car would later compete with each other in the market place, both companies benefited from one another's design and technology expertise, as well as saving money by sharing production costs.

You don't need to be an industry giant to benefit, either. Co-opetition is a particularly useful strategy for agile start-ups. Working co-opetitively with other companies creates mechanisms for effective scaling, extends the influence of smaller companies, and helps to widen access to the market.

In the words of Adventure Capital® founder and managing partner Stuart Richardson, "as big as your dreams are, and as smart as you might think you are, you can't do it alone."

About the Model

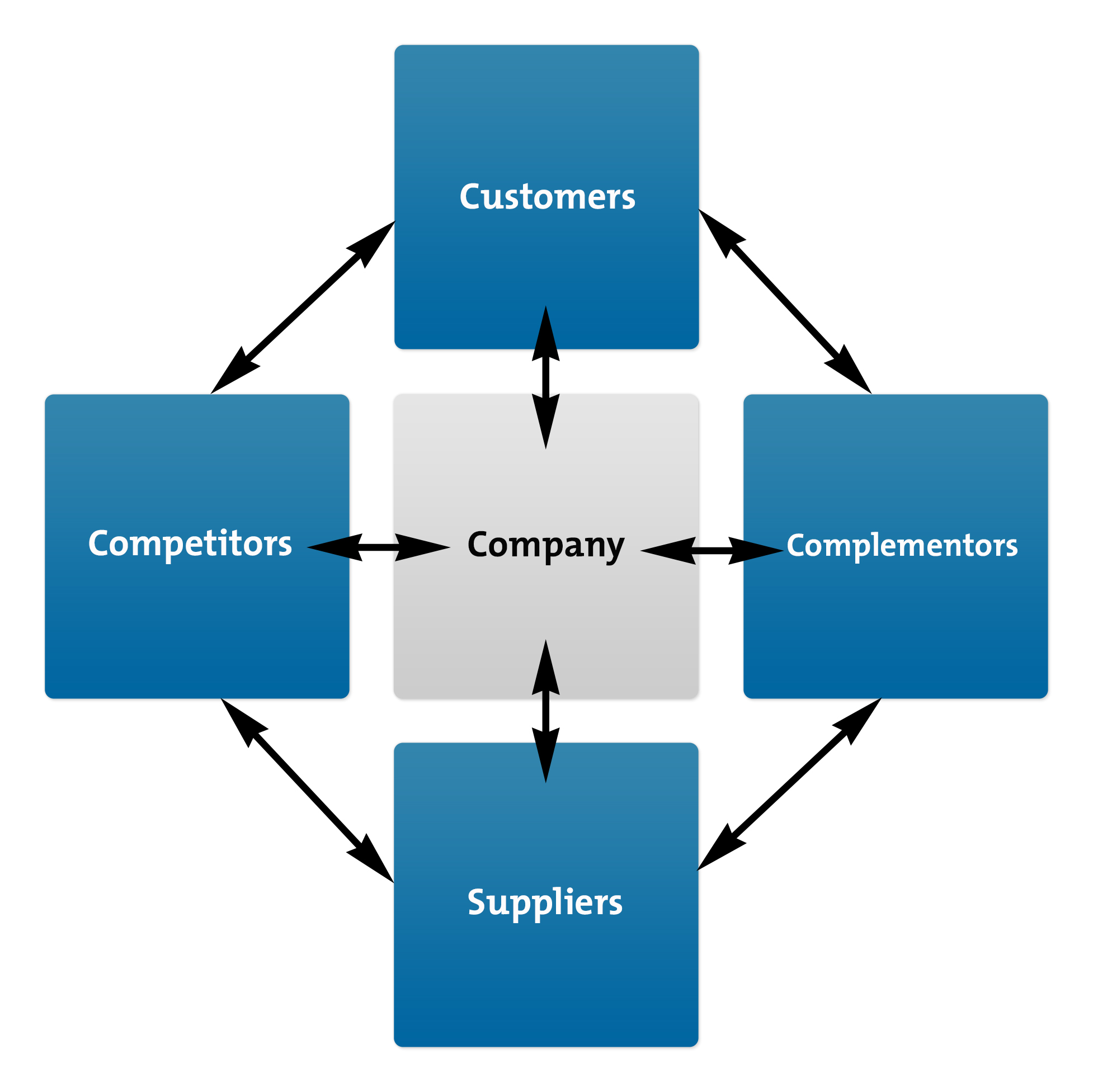

The Value Net Model, seen in Figure 1 below, was developed by Adam Brandenburger and Barry Nalebuff, and published in their 1996 book, Co-Opetition.

The model helps you identify the key players in your business, so that you can predict their behavior more accurately. This helps you make more informed strategic decisions .

Figure 1: The Value Net Model

Excerpt(s) and "The Value Net Framework" from CO-OPETITION by Adam M. Brandenburger, copyright © 1996 by Adam M. Brandenburger and Barry J. Nalebuff. Used by permission of Doubleday, an imprint of the Knopf Doubleday Publishing Group, a division of Random House LLC. All rights reserved.

The model illustrates the interdependencies between yourself and the four other types of player in your business:

- Customers – The people who buy your product or service.

- Suppliers – These provide your organization with the resources you need to produce a saleable product. (Keep in mind that suppliers can be outside organizations, or your own employees.)

- Competitors – Competitors take a share of your target market by offering a similar product or service.

- Complementors – These are other players who provide a product or service that can be linked to your own to make both offerings more attractive to your customers.

The Value Net Model can also be used to highlight the symmetries between the four key players.

For example, customers and suppliers are both located in the vertical dimension. Raw materials and labor flow from supplier to company, where they are converted into products and services before continuing on to the customer.

The company needs both suppliers and customers to be viable. But, while most organizations understand that it's essential to listen to what the customer has to say, they often overlook the value of listening to suppliers.

The same is true of the horizontal dimension between competitors and complementors. Often, organizations shape their strategy exclusively around what their competitors are doing, but miss out on key opportunities to connect and grow with potential complementors.

Removing these blind spots will improve your strategic choices.

The Value Net Model can also help you to understand the unique perspectives of each group better. For example, when you draw the Value Net Model for your own organization, you put yourself in the middle. However, you could also draw the model with your customers in the center. Shifting perspective in this way can help you spot new opportunities for growth.

You might also find that some players occupy more than one role within the web. For example, you and your biggest rival are competitors, but you could also become complementors by negotiating bulk discounts with a key supplier or customer – this is the sort of activity performed by cooperatives, for example.

Tip:

Make sure that you fully understand local competition law before working with competitors. In particular, do not discuss pricing or customer contracting without having taken appropriate legal advice beforehand, as you may be committing a criminal offense by doing so.

How to Use the Value Net Model

To shape your strategy, Brandenburger and Nalebuff suggest using the Value Net Model alongside their PARTS approach. PARTS is an acronym for:

- Players.

- Added value.

- Rules.

- Tactics.

- Scope.

Let's look at these elements in greater detail, and discuss how you can apply each one with the Value Net Model to think about the strategy of your organization.

Step 1: Identify Players

Your first step is to use the Value Net Model to identify the players that influence your business. To do this, list the people and organizations that fall within each role in the model.

Look at the players you've identified. Bear in mind that your own participation in the market makes you a player, too, and consider these questions:

- Are there opportunities for cooperation or competition in any of these relationships?

- Would bringing in extra players (such as additional suppliers or new customers) create any more benefits?

- Who stands to gain from forming a strategic partnership with you? Would any of these players pay you to join them, if their gain was great enough?

- Who stands to lose? Would any of these players pay you to avoid joining forces, if their loss stood to be big enough?

Step 2: Calculate Added Value

Added value measures what each person, in each role, brings to the table. This helps you identify who has the most power, and helps you think about how you might increase the value you provide for others.

To calculate your own organization's added value, identify where you add value through:

- Your USP – how uniquely valuable is your product to the market, and how sustainable is this?

- Supply and demand – can you expand to meet growing demand without creating excess, unused capacity?

- Trade-ons and trade-offs – can you reduce costs in a way that delivers a better product, or deliver a better product in a way that reduces costs? Can you raise costs to make a better product without reducing the customer's willingness to pay?

- Rewards you offer (or could offer) as a "thank you" to customers or suppliers. (Be careful not to contravene local or home country bribery laws when offering rewards.)

- Creating greater customer or supplier loyalty.

Also, think about what the added values are for the other players you identified in Step 1, and look at ways that you can get a share of this for yourself.

Tip:

Michael Porter's Five Forces model is useful for evaluating the relative power of different players in a market. If you haven't used it before, you'll learn a lot by using it to analyze your own business.

Step 3: Define Rules

Every industry has certain established and unwritten "rules" that must be followed. While developing your strategy, evaluate which of these:

- Help your organization.

- Limit what your organization can achieve.

- Could be changed to benefit customers and clients.

- Could be changed in your supplier contracts to your mutual benefit.

Clearly, some rules cannot be changed. However, it might make sense to change others if it allows you to shape your strategy better. Even small changes to some rules can dramatically change the competitive game.

Step 4: Identify Tactics

Each player in the Value Net Model perceives your organization in a certain way. How you shape and manage these perceptions is the foundation of your business tactics. Consider these questions:

- How have you established credibility in your market? Could you offer additional guarantees, free trials or performance contracts to strengthen your credibility and add value?

- Are your organization's actions predictable or unpredictable? If a rival company wanted to "take you on" by offering higher quality goods or services, or more competitive pricing, would you be able to respond, or would you have something else up your sleeve?

- How do your customers perceive your organization? Use the Perceptual Mapping tool to better understand their views.

- Is your product or service priced simply, or is pricing more complex? How would switching from simple to complex, or complex to simple, change others' perceptions and benefit your organization?

Another way to look at tactics is to analyze how much you're spending on branding and advertising. Higher spending often signals that you have greater confidence in your product or service. How might increased (or decreased) spending change perceptions in your market?

Step 5: Define Scope

Scope is perhaps best understood as the boundaries of your game, or market, but these can be extended by linking to other markets. Your goal in this last step is to identify where those links are and whether there are benefits to increasing scope, or whether you should sever existing links to redefine the boundaries.

Key Points

Adam Brandenburger and Barry Nalebuff developed the Value Net Model and published it in their 1996 book, "Co-Opetition." The model helps you identify the key players among your customers, suppliers, competitors, and complementors.

The model is unusual in that it encourages cooperation with other players in order to expand your market and, ultimately, succeed.

When shaping your strategy around your key players, use the PARTS approach:

Step 1: Identify Players.

Step 2: Calculate Added value.

Step 3: Define Rules.

Step 4: Identify Tactics.

Step 5: Define Scope.

Step 2: Calculate Added value.

Step 3: Define Rules.

Step 4: Identify Tactics.

Step 5: Define Scope.

This helps you to define your business strategy and account for the key players you identified with the Value Net Model.

No comments:

Post a Comment